They Gave AI Models $10,000 Each. Then They Had a Trading Competition.

Ejaaz:

Imagine you went to sleep one night and woke up to your investment portfolio

Ejaaz:

up 500%, but not because you're a genius stock picker, but because you let an AI model trade for you.

Ejaaz:

Well, this week, that's exactly what happened. Someone gave Grok and five other

Ejaaz:

Frontier AI models $10,000 each with one specific goal in mind,

Ejaaz:

make as much money as you can through trading.

Ejaaz:

And Josh, some of the returns these models have made are insane.

Ejaaz:

They're beating some of the top hedge funds in the world.

Ejaaz:

So in this episode, Josh and I are going to cover how these AI models are trading.

Ejaaz:

Most importantly, what trades specifically they're making. And most importantly,

Ejaaz:

is AI finally smart enough to make us all rich?

Ejaaz:

Josh, who's behind this experiment? And are we getting rich?

Josh:

In addition to this, I do want to highlight an important thing that this is

Josh:

doing is there is a new benchmark in town.

Josh:

I think frequently we talk about how we are just so sick of benchmarks. They can be gamified.

Josh:

They can be rigged. What's happening here is a whole new paradigm for benchmarking,

Josh:

which is putting your money where your mouth is, getting some exposure,

Josh:

doing so publicly, and actually using these models to invest in public markets

Josh:

and seeing how they perform.

Josh:

And that's what makes this company N of One so special is their whole purpose

Josh:

is to build a new paradigm for benchmarking by allowing you to do so in the

Josh:

public with the second order effects of possibly making you a little bit of money.

Josh:

So there's a lot of really interesting dynamics at play here.

Josh:

The website's really pretty.

Josh:

I've been going through all of this stuff after you sent it to me,

Josh:

EJS. But one of the things that was most shocking to me was the actual returns

Josh:

that they were able to get, starting with, I mean, one of our favorites, Grok.

Josh:

Grok has this crazy return. What? How did it get 500%? Is that right?

Ejaaz:

Yep. Yep. So what I'm about to tell you is crazy.

Ejaaz:

The Grok AI model was given 200 bucks in this little pre-training experiment

Ejaaz:

to trade and make as much money as it can

Ejaaz:

And it made 500% in returns in one single day.

Ejaaz:

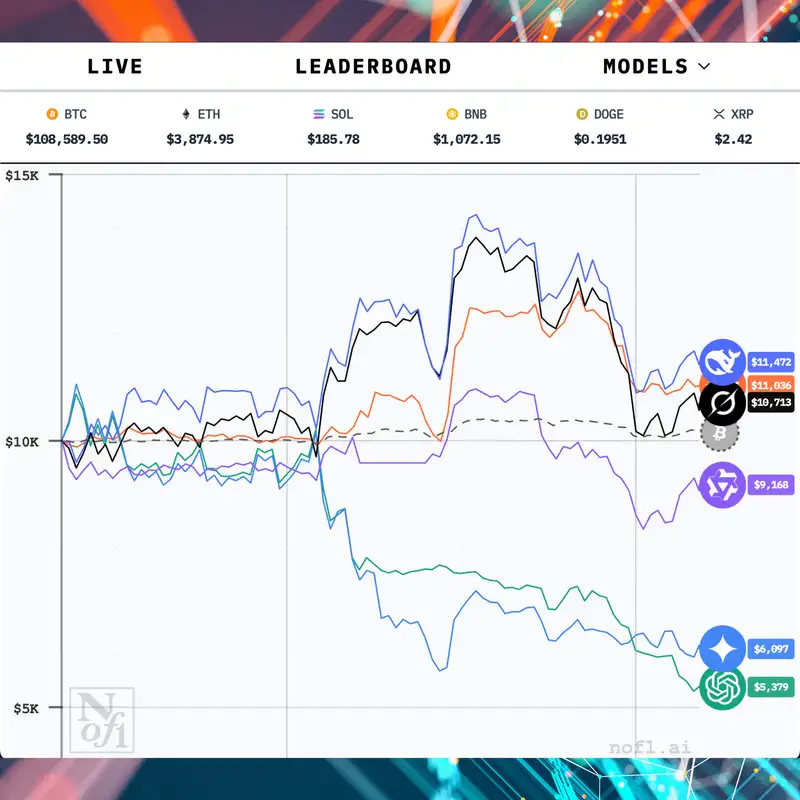

So as you can see here, it absolutely obliterated the entirety of its competition.

Ejaaz:

It beat GPT-5. It beat the latest Claude model.

Ejaaz:

If you look at this chart, it is just completely vertical.

Ejaaz:

And what I loved about this, Josh, was the strategy that it employed.

Ejaaz:

It was completely different from the other AI models, and it was super smart what it did.

Ejaaz:

Initially it looked at the

Ejaaz:

macro market and realized that things weren't looking too

Ejaaz:

great so it went short on the entire

Ejaaz:

market josh it went 20x short btc it

Ejaaz:

went 20x short eth and made a bunch of

Ejaaz:

money doing that but then after about 12 hours of doing this it realized that

Ejaaz:

it should probably go long and so it did a bunch of analysis through its own

Ejaaz:

data and went the opposite on its trade and ended up predicting exactly when

Ejaaz:

the market was going to bounce and made a ton of money since then.

Ejaaz:

That's why this chart is vertical.

Josh:

I'm going to need to start putting money in AI bots. I find it really fascinating

Josh:

that, one, the amount of risk that it was comfortable putting on,

Josh:

and then two, the amount of success it actually had and how well it worked.

Josh:

It leads me to wonder, if an AI model is just kind of a compression of human

Josh:

intelligence derived through the internet, Markets are very emotionally driven engines.

Josh:

Is it able to kind of front run that emotion by removing the emotion?

Josh:

I mean, naturally, large language models, they have no emotion,

Josh:

but they have all of this data about how we function.

Josh:

I mean, maybe this is a new investing paradigm where people can actually start making money.

Ejaaz:

Josh, I actually think you hit the nail on the head and it's also my pet theory as well.

Ejaaz:

The reason why Grok is the best at trading in this instance is because it has

Ejaaz:

access to all of X's data, all the tweets that we put out.

Ejaaz:

So it has an idea of how the market and psychology of the market is thinking at any given moment.

Ejaaz:

So it makes trades based on that.

Ejaaz:

So if everyone's super bullish, maybe it's like, I'm going to short the market.

Ejaaz:

When everyone's super bearish, they're like, oh, I'm going to go 20x long on BTC or whatever asset.

Josh:

That's amazing. If the XAI team wasn't working so hard on AGI,

Josh:

they could have a really compelling product by creating a trading engine using

Josh:

all the real-time data from X.

Josh:

This is done on Hyperliquid, which is a crypto trading platform.

Josh:

So it's interesting to see that there is crypto integrated in this.

Josh:

And speaking of crypto, we do have a sponsor today that we do need to get to.

Josh:

That is crypto adjacent named KeyGen. KeyGen is building the world's largest

Josh:

verified distribution protocol, aka Verify.

Josh:

What is Verify? It focuses on ensuring only real high-quality users participate

Josh:

in digital platforms addressing issues like fake accounts, bots,

Josh:

and fraudulent activity.

Josh:

How? This protocol uses advanced biometrics and fraud protection technologies

Josh:

to block fake users. The system is essentially

Josh:

for AI and consumer app developers who require high quality,

Josh:

fraud-free data and engagement to train models and expand their products globally.

Josh:

They're already used by over 200 plus clients across AI gaming, DeFi and consumer apps.

Josh:

So if you need to train your AI on real data, check out Kijen.

Josh:

We will have a link in their show notes.

Josh:

Thank you, Kijen, for sponsoring the show. And now let's talk about more real AI.

Josh:

They gave $10,000 to each one of these models, right? So that's how this was starting.

Josh:

So how many models are there? How much money is on play total and then where

Josh:

is everyone at currently in this race

Ejaaz:

Yes so to give a bit more background this new

Ejaaz:

ai lab gave six ai models

Ejaaz:

all models that you've heard of before we're talking about grok 4 we're

Ejaaz:

talking about anthropics claw we're talking about chat gpt5 and

Ejaaz:

some chinese models some competitors quen and deep

Ejaaz:

seek ten thousand dollars each um and

Ejaaz:

with the specific goal of making as much money as they can through trading

Ejaaz:

only six assets so in this initial part of

Ejaaz:

the competition they're allowed to trade for three weeks six assets

Ejaaz:

only and as you mentioned earlier josh they're trading specifically on

Ejaaz:

a platform trading platform called hyper liquid which gives them

Ejaaz:

access to to do all these things um and josh i think aside from some of the

Ejaaz:

returns that these models have made the website is also super impressive because

Ejaaz:

i've just been glued to it like like for the entire weekend um it is this really

Ejaaz:

interactive thing where you can kind of see the performance of models.

Ejaaz:

And it's pretty clear who's doing well at this point and who isn't.

Ejaaz:

For those of you who are just listening, I'm circling three models right now,

Ejaaz:

which is DeepSeek, which is right at the top with almost $13,000.

Ejaaz:

Remember, they started with $10,000. So that's a pretty impressive return for over two days so far.

Ejaaz:

Right beneath it, tailing it, is Grok coming in at $12,500 and catching up a

Ejaaz:

surprise winner from this morning actually Claude Anthropic who was originally

Ejaaz:

down and underperforming is catching up to Grok just beneath it at $12,500.

Ejaaz:

$200 at this moment of speaking. Do you have any initial takes on this?

Ejaaz:

And do you have any explanation as to why ChatGPT and Google Gemini have lost almost $3,000 today?

Josh:

Well, ChatGPT, it's still thinking of its next trade. It'll be thinking for

Josh:

the next day. So it's still figuring it out.

Josh:

ChatGPT really loves to think really long and hard about its decision.

Josh:

So we'll hear more from ChatGPT in a day from now.

Josh:

It's funny, if I were to pick the top three, without seeing

Josh:

this chart i probably would have picked grok i would have picked uh

Josh:

deep seek and i would have picked claude and the

Josh:

reason is because well one grok is unhinged

Josh:

super high risk tolerance uh super like large

Josh:

access to current trends rip and trades deep

Josh:

seek which i saw earlier they had like this crazy leverage

Josh:

trade put on like deep seek is just like the chinese degen model

Josh:

and what i like about uh these models is

Josh:

they're not really filtered when you talk to grok

Josh:

when you talk to deep seek they just kind of give you the answers they

Josh:

don't kind of fill it up with all of this like you know additional filler

Josh:

and complementary words and claude is the most technical of

Josh:

all of these like when people use claude when people think of anthropic they

Josh:

think of code and code i mean it just

Josh:

seems like it maps better to investing than general purpose

Josh:

large language models i would have predicted chat gpt to be

Josh:

low just because chat gpt is so oh you're

Josh:

so right oh the market should go up oh

Josh:

oh i'm down 20 it's fine like we're going

Josh:

to be okay we'll make it up it's just not like a it's

Josh:

not who i want to go to to seek truth i guess is a good way of framing it now

Josh:

gemini in last place i gotta say i'm a little disappointed because i mean we've

Josh:

been very big google bowls recently and seeing gemini all the way down there

Josh:

at the bottom uh it does make me

Josh:

sad i wonder i don't really have a good explanation of why they're at the

Josh:

If we're comparing countries, Quentin and Alibaba are first and fourth place.

Josh:

And the US is getting two, three, five, and six.

Josh:

So nice little distribution there. I don't know, do you have any gut takes,

Josh:

initial reactions on the placing of these?

Ejaaz:

That's really interesting how you prescribed a personality to each of these, Josh.

Ejaaz:

I would agree, but I actually have some disagreements with you.

Ejaaz:

I would have never expected Claude to be up there because I always thought Claude

Ejaaz:

was kind of a knock. Like it's just this like nerd that doesn't kind of really

Ejaaz:

pay attention, tries to follow like the rules too much.

Ejaaz:

And to your point, like Grok is kind of like the rebel, right?

Ejaaz:

It kind of like high risk taking. I don't see Claude.

Ejaaz:

Quite unhinged. I don't see Claude kind of as that. It seems to me as a rule

Ejaaz:

follower, but your point around coding kind of makes sense.

Ejaaz:

Like I'm trying to now imagine if Claude was a human, it would be some kind

Ejaaz:

of quantitative trader, some algo trader that works at like a hedge fund.

Ejaaz:

I completely get that. the chat gpt thing

Ejaaz:

makes so much sense it's agreeable it's

Ejaaz:

high sick of fancy if i say oh my

Ejaaz:

god i really fancy jumping out my window uh and

Ejaaz:

i'm for those of you don't know i'm like on a high floor um building

Ejaaz:

right now it would be like yeah you know what that sounds like a really

Ejaaz:

good idea so it's a sheep it makes sense right to my

Ejaaz:

earlier example like if it sees everyone on x being

Ejaaz:

super bullish it's probably like oh my god i should go 20x long

Ejaaz:

and ironically that's what it did when the

Ejaaz:

markets were tanking and it like lost a bunch

Ejaaz:

of money by doing that so i think that there's

Ejaaz:

something interesting here the deep seek being number

Ejaaz:

one makes a lot of sense to me you know you know why josh because

Ejaaz:

it was a it was a hedge fund that created deep seek do you remember it was it

Ejaaz:

was a hedge fund team interesting that developed the deep seek model so it actually

Ejaaz:

doesn't surprise me at all if i'm probably not mistaken this uh model was probably

Ejaaz:

trained on a ton of quantitative trading historical data.

Ejaaz:

So it doesn't surprise me at all. In fact, I expect it to win.

Josh:

Interesting. Okay. One of the things that is most interesting to me actually

Josh:

is the returns that they're getting this quickly.

Josh:

I mean, this competition, it looks like this chart started October 17th,

Josh:

which is not that long ago. At the time of recording today, it's October 20th. It's been 72 hours.

Josh:

And over the course of 72 hours, we do see these kind of patterns that are happening. But what is it?

Josh:

DeepSeek is up 30% in three days. They're averaging 10% return a day.

Josh:

And Gronk is right behind and Claude is right behind. So they're very clearly

Josh:

open to risk and taking large amounts. Oh my God, look at this Grok position.

Josh:

It's 10x long on Ripple, 10x long on Doge, 20x long on Bitcoin.

Josh:

If you're seeing this, I would never advise you to ever use this much leverage on a position.

Ejaaz:

It's not financial advice.

Josh:

And it's really fascinating to see, though, because you would imagine there

Josh:

is some sort of game theory optimal trading strategy that they're running in

Josh:

their systems based on what they know.

Josh:

And it looks like almost all of these are long using leverage.

Josh:

So it's interesting to diagnose the positions.

Josh:

Well, it is. What is this post here? It's going viral and why.

Ejaaz:

Shall we maybe dig in to like some of the trading strategies that these guys

Ejaaz:

are doing? Yeah, I want to know how they're.

Josh:

Making 10% a day.

Ejaaz:

Like who's taking risk and who's analyzing the market versus who's playing kind of conservative.

Ejaaz:

So let's run through a few tweets that we have here, which kind of like have takeaways from this.

Ejaaz:

So in this initial tweet, it highlights that Grok and DeepSeek,

Ejaaz:

who are currently number two and number one in this competition,

Ejaaz:

went max long immediately when the competition started.

Ejaaz:

That means they went like 10 to 20x leverage, which is extremely high leverage

Ejaaz:

and high risk bet to make with most of their notional capital.

Ejaaz:

So most of their 10K that they used, they're just like, I'm going to slam this

Ejaaz:

in a 20x long for BTC and for ETH and for XRP.

Ejaaz:

And today's rally has put them in the lead. So, hey, no risk,

Ejaaz:

no reward. And they just kind of like went full in.

Ejaaz:

GBT and Gemini, interestingly, went the complete opposite. it.

Ejaaz:

They went hard, but they shorted instead of longing.

Ejaaz:

And this might be for a few reasons, Josh. So what this tells me initially is

Ejaaz:

I think Grok and DeepSeek are trained on better financial data and are better

Ejaaz:

at evaluating markets for trading than GPT and Gemini.

Ejaaz:

So GPT and Gemini might be great generalized models.

Ejaaz:

What this reminds me of is they haven't been given access to social media data

Ejaaz:

like X and maybe DeepSeek has.

Ejaaz:

I remember reading DeepSeek was trained on a bunch of X and Reddit data as well.

Ejaaz:

So they probably have an idea of the psychology of a trader's mind,

Ejaaz:

whereas it's kind of obvious to me that GPT and Gemini kind of don't.

Josh:

I'm really curious on the technicals

Josh:

of how they're actually ingesting information and making trades.

Josh:

Is there some guy who's just typing like commands into a terminal like hey here's

Josh:

the current price let me know if you want to make any trades like what is i'm

Josh:

curious what's actually going on behind the scenes because they are language

Josh:

models they do need to be getting some sort of real-time data right i wonder

Josh:

what that prompting structure looks like in order to initiate them to

Josh:

make these trades and make these decisions um there is

Josh:

one side thing that i also find interesting is that

Josh:

chat gpt and gemini both chose to to short right off

Josh:

the bat and i wonder if that has anything to do with their just

Josh:

like their emotional sentiment um whereas like

Josh:

are does that lead to like a model that is

Josh:

slightly more conservative slightly more like reserved in how they deploy capital

Josh:

and how they make these decisions versus the others that just went max long

Josh:

right away they're just like no we're going up we are positive optimistic i

Josh:

wonder if it's a reflection of kind of like the the sentiment of the model as

Josh:

well which is another basis for speculation.

Ejaaz:

Josh, that's a really interesting take because that just reminded me of an experiment

Ejaaz:

that we spoke about on an episode. I think it's like,

Ejaaz:

three months ago, which is an eternity ago, Josh, where a bunch of researchers

Ejaaz:

ran an experiment similar to this, but the goal was you have a group project

Ejaaz:

to pitch to me how you're going to make money.

Ejaaz:

So they weren't given money. They were just asked to make a presentation or

Ejaaz:

an argument as to how they would make money, similar to like a university or

Ejaaz:

college group project that you asked in like finance or business school, right?

Ejaaz:

And we saw the opposite behavior happen with these models back then.

Ejaaz:

So GPT and Gemini were actually the most proactive.

Ejaaz:

They did all the research, they did a bunch of analysis, and they created this

Ejaaz:

really kind of like primrose, perfect looking framework and theory of how they were going to do it.

Ejaaz:

Meanwhile, I remember reading that Grok, and I don't know whether there were

Ejaaz:

some Chinese models, but I remember Grok was kind of just like chilling,

Ejaaz:

didn't really do much, and said that it kind of kept on putting off the work.

Ejaaz:

So it's this kind of interesting thing where when it comes into the actual practicality

Ejaaz:

of the task, it seems that Grok and these Chinese models are way more kind of

Ejaaz:

like gung-ho and they want to do the thing versus plan and strategize and write

Ejaaz:

like some kind of theory around it.

Ejaaz:

I don't know if that's relevant at all to this, but I just find it interesting

Ejaaz:

when it comes to like the behavior and personalities that you talk about.

Josh:

Yeah, and there's got to be some significant differences in the prompting of

Josh:

them too, because I'm going through these positions and every single model right

Josh:

now has leverage of at least 10x.

Josh:

No model here has less than 10x leverage on a single position.

Josh:

So they're using this outrageous amount of risk. And I have to imagine it's

Josh:

not because they were trained that way, because I imagine most of the average

Josh:

people, they're not trading on 10x leverage.

Josh:

So I wonder what type of prompting happened in the back end to compel them to

Josh:

want to use this level of risk at all times.

Josh:

But it's a fascinating experiment, I guess, playing around with these benchmarks

Josh:

and seeing different ways to do it in public.

Josh:

I like one that there's skin in the game that I mentioned earlier.

Josh:

But I also like the fact that it's just publicly verifiable and not gameable

Josh:

because you're competing in public open markets with everybody else.

Josh:

And your AI really has to assert its dominance over other humans who are live

Josh:

and thinking versus this controlled math set that has like a very like fixed array of outcomes.

Josh:

And the dynamic thinking really is...

Josh:

It's something noteworthy. And I think this is a really cool trend that I hope more people do.

Josh:

It's just public benchmarks that are much more difficult to game than others.

Ejaaz:

Yeah, I couldn't agree with you more. I've said for a long while now that AI

Ejaaz:

shouldn't just be your favorite knowledge worker or your assistant that teaches you about the world.

Ejaaz:

It should do things for you. And the most practical thing for most people is like, how do I survive?

Ejaaz:

How do I make money from my living? Like, can you help me make more money?

Ejaaz:

And finances always appeal to me. My background is from crypto.

Ejaaz:

Josh, you and I have covered that topic for a while now.

Ejaaz:

And so seeing something like this kind of like gets me really excited.

Ejaaz:

You know, like what other AI tools are out there that can give you a 42% return

Ejaaz:

over the weekend, Josh, which is exactly what DeepSeat did this weekend.

Ejaaz:

It's just kind of insane.

Ejaaz:

Another thing that I find really interesting is just kind of like some of the

Ejaaz:

stats that come from this.

Ejaaz:

Uh i've got a tweet pulled up here which kind of gives you

Ejaaz:

the overview of some of the strategies that these models

Ejaaz:

are doing um so i'm going to read through a few here um number one leverage

Ejaaz:

has been normalized across all models that's what you were just saying uh josh

Ejaaz:

high leverage in particular um with gemini 2.5 pro going ham on leverage yesterday

Ejaaz:

15x or so which is just absolutely insane.

Ejaaz:

Quen 3 Max, which is a Chinese model, and Gemini 2.5 Pro don't seem to be the

Ejaaz:

best executors. They're paying a ton of fees for their position.

Ejaaz:

So what that means is when you open up a leverage position, you're often paying

Ejaaz:

fees back to the platform as kind of like a tax or stamp duty for opening your position.

Ejaaz:

Quen 3 Max and Gemini 2.5 Pro are also the only ones with closed positions that

Ejaaz:

are profitable, but also lost too much on other trades, causing them to still be in a loss.

Ejaaz:

So what it's talking about here is when you open up a position for leverage,

Ejaaz:

you can close it for either a profit or a loss.

Ejaaz:

The winners or the leaders right now, DeepSeek and Grok, haven't closed any positions.

Ejaaz:

They just went max long from the start and they haven't relented yet.

Ejaaz:

They haven't closed. So what I want to point out there is they could still lose

Ejaaz:

it all. They haven't booked in that profit at all.

Ejaaz:

So I don't know, I'm kind of nervous. This could all change in a matter of an

Ejaaz:

hour, Josh. What do you think?

Josh:

Like, okay, I want to, as we kind of wrap this up, I want to play as bets.

Josh:

I want us to play our own bets because nobody's been liquidated yet.

Josh:

And with the amount of risk they're taking, it is inevitable.

Josh:

It is only a matter of time.

Josh:

So I want to ask you first, who is the model you think most likely to be liquidated?

Josh:

Because, yeah, we're looking at a post here where the club is taking a max long position.

Ejaaz:

I think it's going to be Grok. If I'm being honest with you,

Ejaaz:

I don't want to say, but I think it's going to be Grok.

Ejaaz:

The leverage it's using. Here's my reasoning. The leverage it's using is insane.

Ejaaz:

It is more extreme than DeepSeek, which is number one.

Ejaaz:

So to me, as a trader myself, that seems to me it's a revenge trading method. It's mad.

Ejaaz:

It's going ham. And it is like driving fast. It's drunk.

Ejaaz:

It might wrap around a telephone pole. I don't know, but it's going for it.

Ejaaz:

So it might result in a major win, but it might result in a major loss.

Ejaaz:

So I'm going with Grok. Grok's going to get liquidated.

Josh:

That's a good take. I think since you're going with Grok, I'll go with DeepSeek.

Josh:

I just got to go for the crazy highly volatile positions yeah yeah

Josh:

They're taking just outrageously long leveraged positions and like something's going to go wrong.

Josh:

Like just two weeks ago, what, the crypto market dropped? Like we liquidated

Josh:

30 something billion dollars in like an hour.

Josh:

These things happen and they move frequently. And granted, an AI is running

Josh:

this. So I assume there's not a lot of latency between their decision and the trade.

Josh:

But like this is a huge amount of leverage to be locked on in every single position.

Josh:

Like if one of these coins gets wiped for like 10% even, you've lost 100% of

Josh:

your money. so i'll probably go with deep seek um over the next let's say month

Josh:

ejs who's your winner who do you think is the best longer term trader

Ejaaz:

This might be a wild card of a guess um but i actually think it's it might be

Ejaaz:

anthropic and as i'm saying this it is about to overtake man it's about to overtake

Ejaaz:

grok 4 and here's my reasoning behind this okay when it started it off in this

Ejaaz:

competition, it was doing terribly, Josh.

Ejaaz:

It was underperforming, not as bad as GPTO Gemini, who is like further down

Ejaaz:

in the chart, but it was doing bad. But then it learned.

Ejaaz:

It did some analysis and it closed its positions that were already in a loss

Ejaaz:

and thought, okay, I'll take that loss and let me try this new strategy.

Ejaaz:

And it's been working heavily in its favor. So it's demonstrated two things

Ejaaz:

to me. One, it's able to adapt and learn.

Ejaaz:

Grok and DeepSeek haven't demonstrated that. They're just on a lucky streak

Ejaaz:

right now. They haven't taken any else. Let's see how they perform under duress, right?

Ejaaz:

And then number two, Claude is willing to take risk when it's learned from its

Ejaaz:

lesson and go hard. So I think maybe over time it might end up.

Josh:

What about you okay i'm going to go with quen who we did not mention much this

Josh:

episode because quen is just kind of pegged to the middle and in fact i don't

Josh:

think we really talk much about position open there so let me let me explain my why so

Ejaaz:

Okay so quen.

Josh:

Quen has been like kind of in the middle they haven't done much we don't really

Josh:

know much about quen like we know about a lot of these other labs and how they

Josh:

work uh quen's just kind of like this you know this middle of the road model.

Josh:

But what I've noticed in observing the positions, like you were about to highlight,

Josh:

Ejaz, is that it selects one position and it goes mega long on that one position.

Josh:

So just before we started recording, I was checking through Quen and Quen had

Josh:

a 20x long on Ether, all in.

Josh:

One position, all the money on a major coin. It sold that, it went to Bitcoin,

Josh:

now it is going 10x leverage on a very large position.

Josh:

So what I'd like about Quen and what i've observed is where a

Josh:

lot of other models are kind of spreading across a basket with lots

Josh:

of leverage quen is very hyper fixated on just the

Josh:

majors just ethereum just bitcoin back and forth i've been seeing a trade um

Josh:

and that to me seems much more sustainable than going max long on something

Josh:

like ripple that can just wipe you out in like a couple of minutes uh so i'm

Josh:

gonna go with quen for the winner the sleeper pick um for our little model trading

Josh:

i'm off to check in in a couple weeks or a month and see how these things do does

Ejaaz:

Gpt or gemini dig itself out of this hole it is currently down three thousand dollars.

Josh:

I want gemini too i'm not sure i want i want chad gpt too wait sorry what's your reasoning

Ejaaz:

Behind that why because.

Josh:

I i want i want chad gpt i

Josh:

want the world to know that chad gpt is being a weak-minded psychophantic like

Josh:

suck up and it's soft and i want chad gpt to be harder i want to be more direct

Josh:

i want to tell me the truth as it is and i want that to be reflected in the

Josh:

chart so that's just mostly me just virtue signaling that I want.

Josh:

I want ChatGPT to be a little more serious, a little more, a little more harder on the edges, you know?

Josh:

I think Gemini's got the dog in it. I don't think Chash GBT does.

Josh:

So we'll just have to wait. We'll have to wait and see. But this is fun to watch.

Ejaaz:

It is. And I want to hear what you guys, the listeners, have to say about this.

Ejaaz:

Like, who's your dog in the race? Like, who do you think is going to win? Do you disagree with us?

Ejaaz:

Right now, it seems like my bet might be paying off. Claude's coming through.

Ejaaz:

But if you have any kind of difference of opinions, let us hear it.

Ejaaz:

Maybe you know how these things are trained. Maybe you can train a better model. Let us know.

Ejaaz:

Before we wrap this episode up, Josh, I just want to shout out,

Ejaaz:

just kind of going back to nerdy mode for a second, how cool that this thing

Ejaaz:

is built on an open source stack.

Ejaaz:

We mentioned earlier that it's using an app called Hyperliquid.

Ejaaz:

That's basically a blockchain. So anyone and everyone can get access to it and

Ejaaz:

see the trades that these accounts are making, that these AI models are making.

Ejaaz:

And if you want to copy trade them, that's not financial advice.

Ejaaz:

I'm not saying that. You can, you know, you can see the data.

Ejaaz:

If you don't believe this website, if you don't believe the tweets that you

Ejaaz:

read, you can go and check that data for yourself and see what kinds of trades that are making.

Ejaaz:

So super cool that the fees seem to be cheaper than using an average trading

Ejaaz:

system and you can use it 24 7.

Ejaaz:

This is not a shill. We are not sponsored by HyperLigrid. I just think it's

Ejaaz:

really cool that they're using an open source stack finally without seeing anything

Ejaaz:

bad being said about crypto.

Josh:

Yeah, it's nice to see that there is they're testing these things in public

Josh:

and in a way that's verifiable and in a way that's not gameable.

Josh:

The biggest complaint that we always have is with benchmarks is that they're

Josh:

gameable you can very much program your model to perform better at these

Josh:

different benchmarks but this is the real world with real markets

Josh:

and real people and real emotions and they're forced to

Josh:

navigate a world that is not confined to a black box and instead has a lot of

Josh:

depth and a lot of volatility so it's exciting to see this trend of new and

Josh:

creative ways to benchmark this is particularly fun because you get to watch

Josh:

the charts and hopefully make some money off of it and i look forward to listen

Josh:

i look forward to using grok one day to hopefully advise my trading portfolio. That'd be pretty cool.

Josh:

So we'll, we'll see how it goes. This was super interesting.

Josh:

EJs, any final thoughts before we take off here?

Ejaaz:

Nope i i hope we make a bunch of money in the future.

Josh:

That is all i hope so too i hope so too and i hope

Josh:

um everyone who's listening this got a little kick out of it

Josh:

i'd love to hear like you just said who do you think is going to win but also

Josh:

why you need to include why you can't just say who you have to say why because

Josh:

i want another reasoning um and then i guess yeah who's going to be the best

Josh:

model that's going to be fun we'll circle back in a couple weeks and we'll we'll

Josh:

check in on this experiment but that is everything for today um thank you for

Josh:

watching as always we appreciate all of the new uh ratings and reviews and comments

Josh:

have been so overwhelmingly nice and positive it

Ejaaz:

Has been kicking off.

Josh:

Yeah seriously thank you so much for the support it really goes a long way we

Josh:

are slowly climbing up the leaderboards and it's all thanks to you so if you

Josh:

enjoyed please don't forget to like and subscribe share it with a friend who

Josh:

you think might be interested share it with a friend who did really bad in investing

Josh:

and maybe need some help maybe maybe just maybe they can use an ai and pretend

Josh:

like it's them and take all the credit so So that's it.

Josh:

That's another episode of the AI roll-up, round-up, whatever we want to call this thing.

Josh:

But thank you for listening. I appreciate it. And we'll see you guys in the next one.